Supporting Your Existing Investment. Extending Its Value.

People‑counting systems are typically installed for long periods. After five to nine years, most are still running, but the cost structure, capability, and risk profile are no longer optimal.

Contract renewal is usually the only point where organisations are expected to reassess whether continuing with the same system still makes sense. This programme exists to support that reassessment in a structured, transparent way.

Legacy System Replacement Programme

What This Programme Is

This programme is:

- A structured replacement option for ageing people‑counting systems

- Designed specifically for renewal or late‑lifecycle situations

- Focused on cost efficiency, continuity, and practical improvement

This programme is not:

- A general upgrade campaign

- A mandatory replacement

- A discount or clearance programme

- A requirement to adopt advanced analytics

When It Applies

The programme is intended for organisations that meet most of the following:

- Existing people‑counting system installed ≥ 5 years ago

- Contract renewal due or upcoming

- Ongoing service, maintenance, or analytics fees

- Limited ability to improve capability on the current platform

- Internal requirement to demonstrate renewal‑time due diligence

Eligibility is confirmed through a short technical review. Participation does not require commitment.

Renewal Options

The Default Renewal Path

In most cases, renewal results in:

- The same hardware remaining in place

- The same service scope continuing

- Recurring fees rolling forward

This may be acceptable. The programme simply provides an alternative option to review whether replacing ageing hardware would reduce cost or improve capability over the next lifecycle.

What a Pro2 Replacement Includes

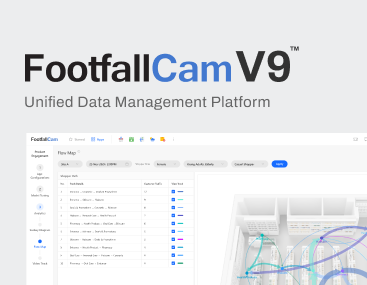

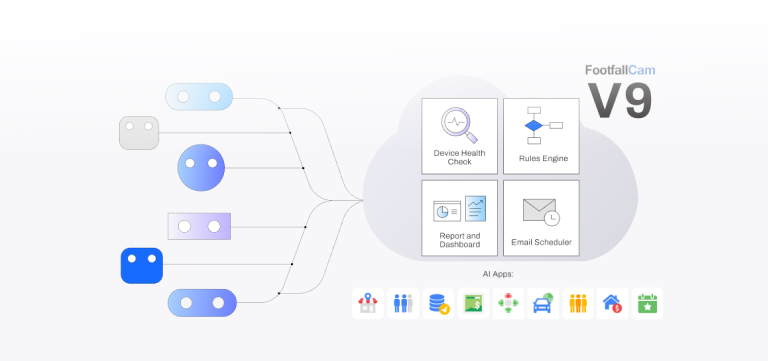

Where replacement proceeds, legacy devices are replaced with the current Pro2 platform.

Included as standard:

- Wide‑angle coverage per device

- High‑accuracy people counting

- Outside and transitional area visibility (where applicable)

- Demographics and group counting

- Staff exclusion (uniform‑based)

- Advanced and predictive analytics capability

- Improved data handling and role‑based access

Retailers can continue using simple in‑out and footfall metrics if that is all they need today. The value is in having a modern foundation that does not need to be replaced again to move forward later.

How it Works

How Replacement Is Carried Out

Replacement is handled as a controlled operational process. Existing cabling and mounting points are reused wherever possible, keeping installation fast and non‑disruptive.

- Suitability review

- Physical swap of devices

- Guided calibration

- Side‑by‑side performance verification

- Acceptance once data quality is confirmed

Replacement only proceeds when performance meets or improves on the existing system.

Validation Before Any Commitment

For eligible cases, the programme includes access to a validation unit. This allows teams to see real performance in their own environment before making a decision.

The validation is limited in scope, time‑bound, and provided with no obligation to proceed. Its purpose is to support proper due diligence, not to push an outcome.

Replacement only proceeds when performance meets or improves on the existing system.

Commercial Options

Different organisations have different financial structures. The programme supports several approaches:

- Outright replacement

- Phased replacement across an estate

- Replacement aligned with contract renewal

- Analytics‑as‑a‑Service for OPEX‑focused teams

Commercial discussions take place after validation, based on confirmed suitability and performance.

Renewal Outcomes

Expected Renewal Outcomes

Retailers using the programme typically achieve one or more of the following:

- Lower long‑term cost compared to renewal

- Wider and more consistent coverage

- Improved trust in footfall data

- Reduced maintenance and support risk

- A modern baseline without operational disruption

Outcomes depend on site conditions and commercial context.

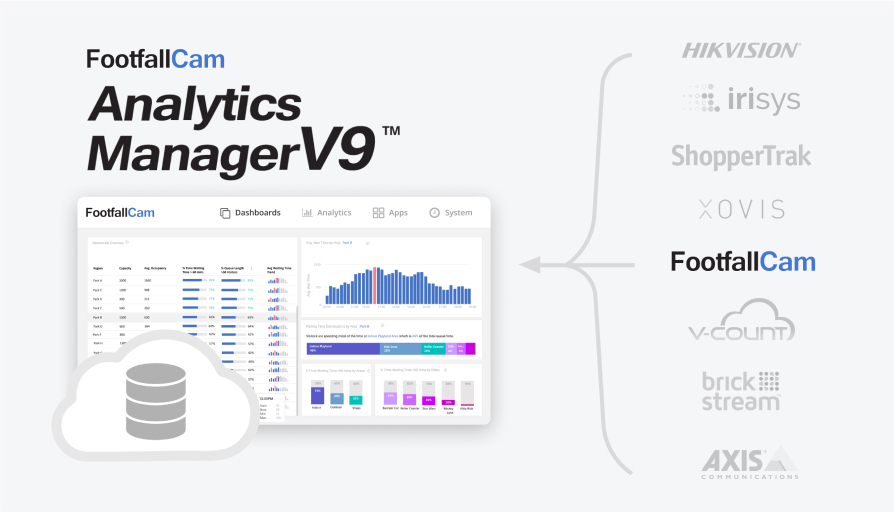

This offer is exclusively for businesses no longer purchasing new devices from other vendors but planning to transition or migrate to FootfallCam’s V9 platform.

Case Study

National Fashion Retailer

Case Study 1

Contract Renewal Without Added Value

Business: National Fashion Retailer

Type: Apparel & Accessories

Estate Size: ~180 stores

Country: Germany

Situation

The retailer had been operating the same people-counting system for over eight years under a recurring SaaS model. While the system remained operational, renewal discussions revealed that the service scope had not meaningfully changed in several contract cycles. Reporting remained limited to basic in/out counts, with little transparency into data processing or roadmap development.

The vendor continued to charge recurring fees with minimal incremental investment, and internal stakeholders began questioning whether the cost still reflected the value being delivered.

Consideration

At renewal, the retail operations team initiated a formal due-diligence review. The objective was not to disrupt store operations, but to evaluate whether modern alternatives could provide broader coverage, better accuracy, and improved analytics at a lower long-term cost.

The review highlighted that newer platforms could deliver wider coverage per device, include demographics and staff exclusion as standard, and reduce overall maintenance burden without changing existing cabling or store layouts.

Outcome

A staged legacy replacement was approved. Devices were swapped during normal maintenance windows using existing infrastructure. The retailer achieved a measurable reduction in annual operating cost while expanding analytics capability. Most importantly, renewal discussions shifted from price defence to value optimisation, and the new baseline was accepted as more sustainable for the next lifecycle.

Grocery & Convenience Chain

Case Study 2

Introducing Competition to Reset Commercial Terms

Business: Grocery & Convenience Chain

Type: Food Retail

Estate Size: ~420 stores

Country: United Kingdom

Situation

The retailer had a long-standing relationship with a single vendor supplying people-counting hardware and analytics under a bundled service agreement. Over time, the lack of competitive pressure resulted in rigid commercial terms and limited flexibility around service scope.

While the system functioned adequately, procurement and finance teams felt that renewal discussions lacked leverage.

Consideration

Rather than committing immediately to renewal, the retailer introduced a competitive reassessment process. The intent was to validate performance, explore alternative commercial models, and benchmark pricing against current market conditions.

The legacy replacement programme allowed the retailer to trial a modern system alongside the incumbent, without disrupting stores or committing to a full rollout.

Outcome

The competitive evaluation resulted in significantly improved commercial terms. In some regions, the retailer adopted the new platform; in others, the incumbent responded with improved service levels and pricing. In both cases, competition achieved its objective: better value, clearer accountability, and a more balanced vendor relationship.

Regional Shopping Centre Operator

Case Study 3

Forced Change After Legacy Support Degradation

Business: Regional Shopping Centre Operator

Type: Commercial Property

Estate Size: 12 malls

Country: Spain

Situation

The operator relied on a legacy care and maintenance system that had gradually become harder to support. Replacement parts were limited, firmware updates were infrequent, and response times had increased.

Operational teams were reluctant to change due to perceived risk, but support degradation had begun to affect reporting reliability.

Consideration

After several incidents, management concluded that continued reliance on ageing hardware posed greater risk than replacement. The priority was continuity, not feature expansion.

The replacement programme offered a controlled path to modernise infrastructure without redesigning the estate or retraining staff extensively.

Outcome

Devices were replaced site by site with validated performance checks. Support incidents decreased, reporting stabilised, and operational risk was reduced. The decision was later recognised internally as preventative rather than reactive.

Electronics Retailer

Case Study 4

Data Trust Erosion Due to Staff Movement

Business: Big-Box Electronics Retailer

Type: Consumer Electronics

Estate Size: ~95 stores

Country: United States

Situation

The retailer experienced high staff turnover and frequent staffing adjustments. The existing people-counting system struggled to distinguish staff from customers, leading to inconsistent data. Store managers increasingly distrusted reports, undermining the usefulness of analytics for decision-making.

Consideration

Rather than expanding analytics complexity, the retailer focused on improving baseline data quality. The objective was to restore trust in footfall numbers before exploring advanced insights.

The replacement programme provided improved accuracy, standard staff exclusion, and better handling of group behaviour.

Outcome

Data confidence improved significantly. Store teams began using reports again, and head office regained visibility into trends. The retailer deferred more advanced analytics until teams were ready, but benefited immediately from cleaner data.

International Transport Hub Operator

Case Study 5

Lack of Enterprise Data Sharing

Business: International Transport Hub Operator

Type: Transportation & Infrastructure

Estate Size: 3 major hubs

Country: Asia-Pacific

Situation

People-counting data was siloed within a single department and not easily shared across operations, planning, and commercial teams. The existing system lacked role-based access and integration capabilities, limiting enterprise-wide value.

Consideration

At renewal, leadership sought to improve data accessibility without increasing operational complexity. The focus was on governance, security, and controlled sharing rather than analytics depth.

Outcome

Following replacement, data was shared securely across teams with clear access controls. Integration with other enterprise systems improved collaboration and planning. The organisation viewed the replacement as an enabler of better internal alignment rather than a technology upgrade.

Home Improvement Retail

Case Study 6

Rising Maintenance Cost Exceeding Replacement Value

Business: National DIY & Home Improvement Chain

Type: Home Improvement Retail

Estate Size: ~140 stores

Country: France

Situation

The retailer had operated the same people-counting hardware for over seven years. While the system remained functional, maintenance costs had increased steadily. Replacement parts were scarce, firmware updates were infrequent, and on-site intervention costs were rising.

Finance teams noted that annual maintenance and service fees were approaching a level comparable to replacing the hardware outright over a short horizon.

Consideration

At renewal, the retailer conducted a cost comparison between continued maintenance and a controlled replacement. The objective was not to add complexity, but to stabilise cost and reduce operational risk.

The replacement programme allowed the retailer to reuse existing cabling and mounting, significantly lowering installation cost and downtime.

Outcome

The retailer approved a phased replacement across the estate. Annual maintenance expenditure dropped, support incidents reduced, and operational predictability improved. Internally, the decision was justified as a cost-control measure rather than a technology refresh.

Lifestyle & Sporting Goods Retailer

Case Study 7

Store Expansion Exposed Coverage Limitations

Business: Lifestyle & Sporting Goods Retailer

Type: Specialty Retail

Estate Size: ~85 stores

Country: Australia

Situation

Several stores underwent refurbishment and expansion, increasing entrance widths and internal circulation space. The existing people-counting devices, installed years earlier, were no longer able to cover the full area accurately without adding more hardware.

This created inconsistencies across the estate, with newer stores reporting different quality data compared to older locations.

Consideration

Rather than increasing device density, the retailer reviewed whether newer hardware could provide wider coverage per unit and restore consistency across stores.

The legacy replacement programme offered a way to standardise the hardware baseline without redesigning store layouts.

Outcome

The retailer replaced legacy devices with a wider-coverage platform. Coverage improved, device count stabilised, and reporting consistency returned across the estate. Expansion projects were simplified, and future store designs no longer needed to accommodate additional counters.

Healthcare Retail

Case Study 8

Security and Compliance Requirements Tightened

Business: International Pharmacy Chain

Type: Healthcare Retail

Estate Size: ~310 stores

Country: Canada

Situation

New internal security and data governance standards were introduced, requiring clearer access control, auditability, and tighter integration with corporate IT policies. The legacy people-counting system lacked role-based access and modern data-handling controls.

While the system functioned technically, it no longer aligned with corporate compliance expectations.

Consideration

Rather than extending exceptions for an ageing platform, the IT and compliance teams recommended replacement at renewal to bring the system into line with updated policies.

The replacement programme offered improved data management and integration without increasing operational burden.

Outcome

After replacement, the system passed internal audits with fewer exceptions. Data access became more transparent, and compliance teams reduced oversight effort. The replacement was framed internally as a compliance alignment exercise, not a technology upgrade.

Quick-Service Restaurant

Case Study 9

Declining Confidence in Reported Trends

Business: Quick-Service Restaurant Franchise Group

Type: Food & Beverage

Estate Size: ~260 outlets

Country: Southeast Asia

Situation

New internal security and data governance standards were introduced, requiring clearer access control, auditability, and tighter integration with corporate IT policies. The legacy people-counting system lacked role-based access and modern data-handling controls.

While the system functioned technically, it no longer aligned with corporate compliance expectations.

Consideration

Rather than extending exceptions for an ageing platform, the IT and compliance teams recommended replacement at renewal to bring the system into line with updated policies.

The replacement programme offered improved data management and integration without increasing operational burden.

Outcome

After replacement, the system passed internal audits with fewer exceptions. Data access became more transparent, and compliance teams reduced oversight effort. The replacement was framed internally as a compliance alignment exercise, not a technology upgrade.

Forecourt & Convenience

Case Study 10

Reporting Used for Compliance, Not Insight

Business: National Fuel & Service Station Operator

Type: Forecourt & Convenience

Estate Size: ~520 sites

Country: Italy

Situation

The operator used people-counting primarily to satisfy compliance and landlord reporting requirements rather than operational insight. Reports were generated monthly but rarely interrogated. The existing system was reliable enough but provided little transparency or flexibility.

As renewal approached, finance questioned why a system that delivered minimal operational value continued to carry a significant recurring cost.

Consideration

The objective was not to add advanced analytics, but to reduce cost while maintaining compliance and improving optional visibility for operations teams. The replacement programme allowed the operator to assess whether a modern baseline could deliver the same reporting obligations with improved accuracy and lower ongoing cost.

Outcome

Following replacement, the operator retained compliance reporting while reducing annual service expenditure. Some regions began using the improved data for site planning and staffing, but this was optional. Internally, the decision was positioned as cost rationalisation with added upside.

Franchise Retail

Case Study 11

Vendor Roadmap No Longer Aligned

Business: Mid-Market Fashion Franchise Group

Type: Franchise Retail

Estate Size: ~75 stores

Country: Netherlands

Situation

The incumbent vendor had gradually shifted focus toward large enterprise clients, with new features and roadmap priorities misaligned with the franchise group’s needs. Smaller customers experienced slower response times and fewer meaningful updates.

The system still worked, but the retailer felt increasingly peripheral.

Consideration

At renewal, leadership decided to reassess whether staying with a vendor whose roadmap no longer matched their scale and priorities made sense. The replacement programme offered a way to move to a platform designed to support both simple use cases and future growth.

Outcome

The group replaced legacy devices across the estate. Support responsiveness improved, and the platform felt proportionate to their operational needs. The change was framed as aligning with a vendor whose direction better matched the business.

Multi-Brand Retail

Case Study 12

Mergers Created Inconsistent Data Baselines

Business: Multi-Brand Retail Holding Company

Type: Retail Group

Estate Size: ~210 stores across 4 brands

Country: United States

Situation

Following acquisitions, the group inherited multiple people-counting systems from different vendors. Data definitions, accuracy levels, and reporting formats varied significantly, making cross-brand analysis difficult.

Attempts to normalise data at the reporting layer proved complex and unreliable.

Consideration

Rather than harmonising legacy systems, the group chose to standardise the hardware baseline during renewal cycles. The replacement programme allowed a gradual transition without forcing immediate estate-wide change.

Outcome

As stores renewed contracts, legacy devices were replaced with a single platform. Data consistency improved, enabling group-level analysis. The initiative was viewed internally as infrastructure standardisation rather than analytics expansion.

International Airport Retail

Case Study 13

Landlord Reporting Requirements Increased

Business: International Airport Retail Concessionaire

Type: Travel Retail

Estate Size: ~60 outlets across multiple airports

Country: Middle East

Situation

Airport landlords introduced stricter reporting requirements, including more granular footfall and dwell metrics. The existing system could not easily meet these requirements without additional modules and cost.

Failure to comply risked commercial penalties.

Consideration

The concessionaire assessed whether upgrading the existing system or replacing it would be more effective. The replacement programme demonstrated that newer hardware could meet reporting requirements as standard, without incremental complexity.

Outcome

The concessionaire replaced legacy systems in key locations. Reporting compliance improved, and relationships with landlords strengthened. The replacement was justified as a contractual necessity rather than discretionary spend.

National Department Store Chain

Case Study 14

Internal Push for Asset Optimisation

Business: National Department Store Chain

Type: Department Stores

Estate Size: ~48 stores

Country: South Korea

Situation

Corporate leadership launched an asset optimisation initiative, requiring each department to review long-standing contracts and identify opportunities to improve value without increasing budgets.

The people-counting system had not been reviewed in nearly a decade.

Consideration

Rather than requesting new funding, the operations team proposed replacing ageing hardware as part of contract renewal. The replacement programme allowed them to demonstrate improved capability, lower long-term cost, and better data governance within the existing budget envelope.

Outcome

The replacement was approved and completed without disruption. Leadership recognised the initiative as an example of responsible asset management. The team gained credibility for improving outcomes without additional spend.

FAQs

Learn More